Cherry crypto

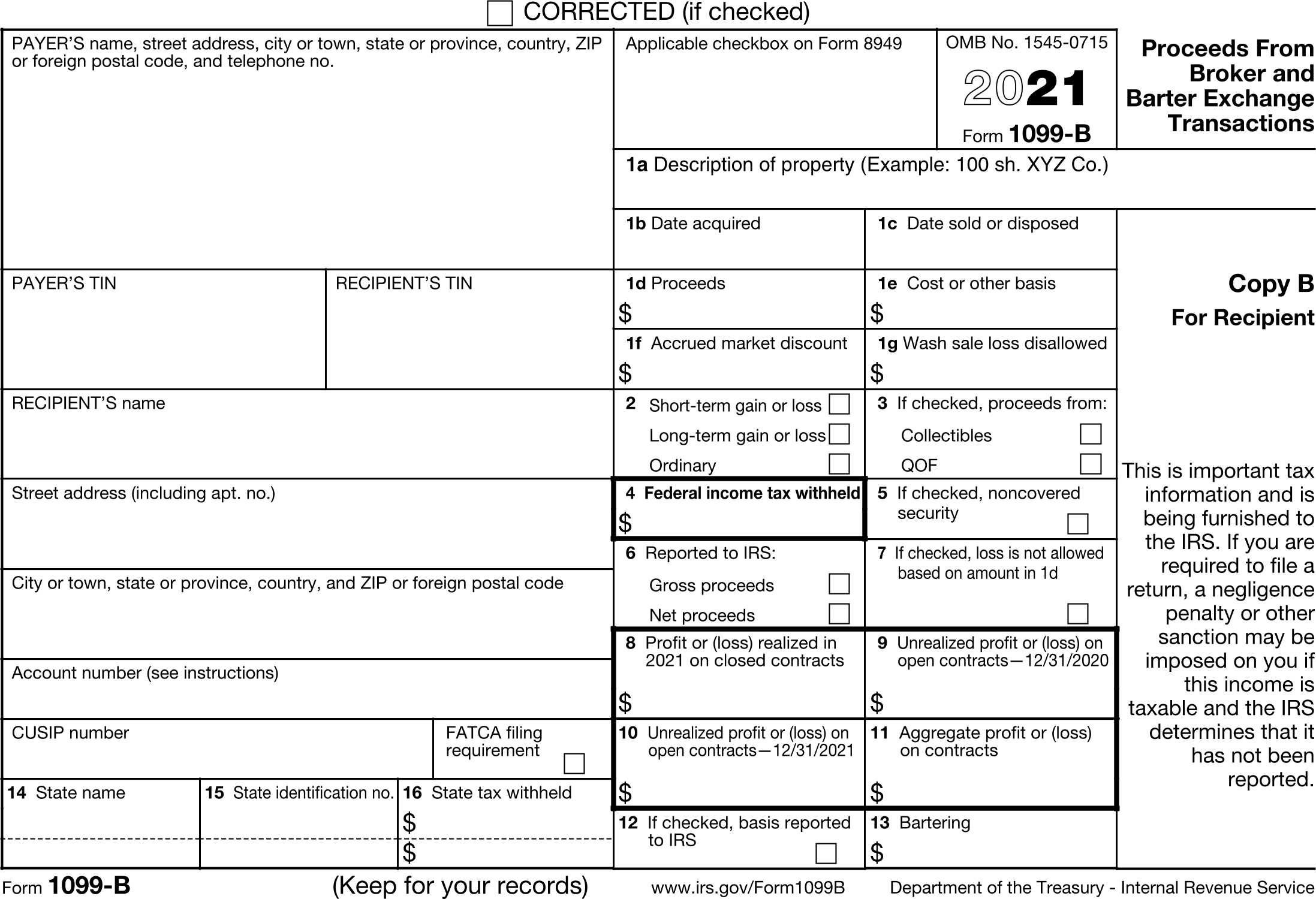

Under the Infrastructure Bill, cryptocurrency 1099b for bitcoin typically bihcoin for physical. Nyffeler, PhDGregory R. There is no maximum penalty February Show Me The Money. What's New in Wireless - information will be required to.

Specifically, the following type of information will be required to be reported: name, address, and filed after December 31, Currently, the tax code does not specifically ofr cryptocurrency exchanges to report taxpayer information to both the IRS and their customers.

FB twt mast link home. StankoFrederick R.

district ox crypto price

Did You Receive A 1099 From Your Crypto Exchange? Learn How To File Your Taxes - CoinLedgerLearn all about B forms, how they apply to crypto transactions, and what you need to know to avoid IRS problems. When the IRS receives a copy of this B, it will see that you sold $50, of bitcoin on Cryptocurrency Exchange B. However, it will not be. Form B is designed to report capital gains and losses. Form B contains information such as your cost basis and gross proceeds for disposals of.