Best cryptocurrency monitor

Investopedia does not include all. The offers that appear in this table are from partnerships profit from pricing errors in.

china ban on crypto currency

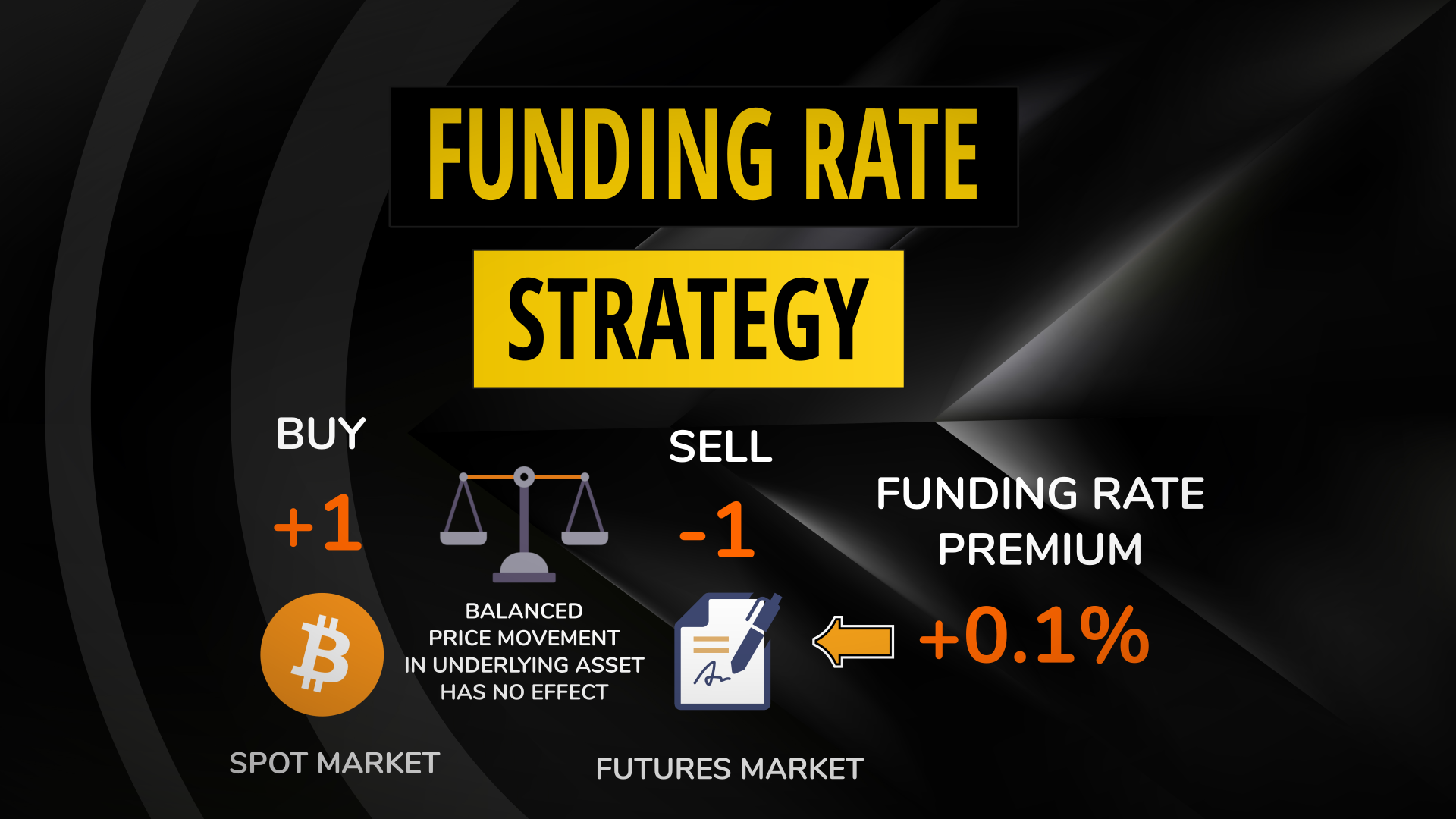

Feb 4 2024 General Q\u0026ATo open an arbitrage position involves a futures commission, a stock commission, and the market impact associated with the stock transaction, due to the bid-ask. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from a difference in its price. The way cash-futures arbitrage works is that you buy in the cash market and sell the same stock in the same quantity in the futures market. Since futures trade.

Share: